Privacy‑First AI: A Practical Enterprise Framework

A practical blueprint to run privacy‑first, AI‑driven programs at scale.

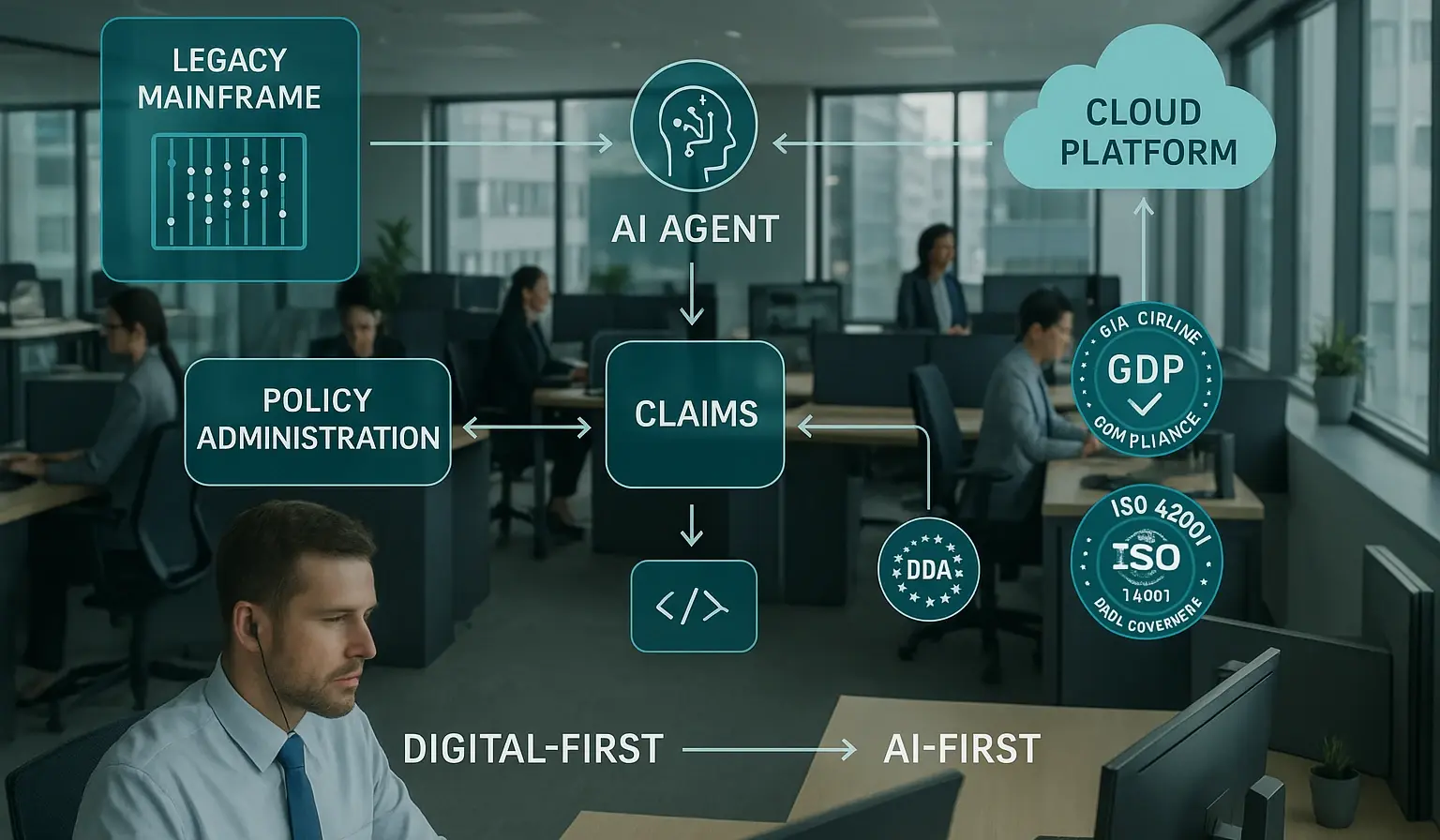

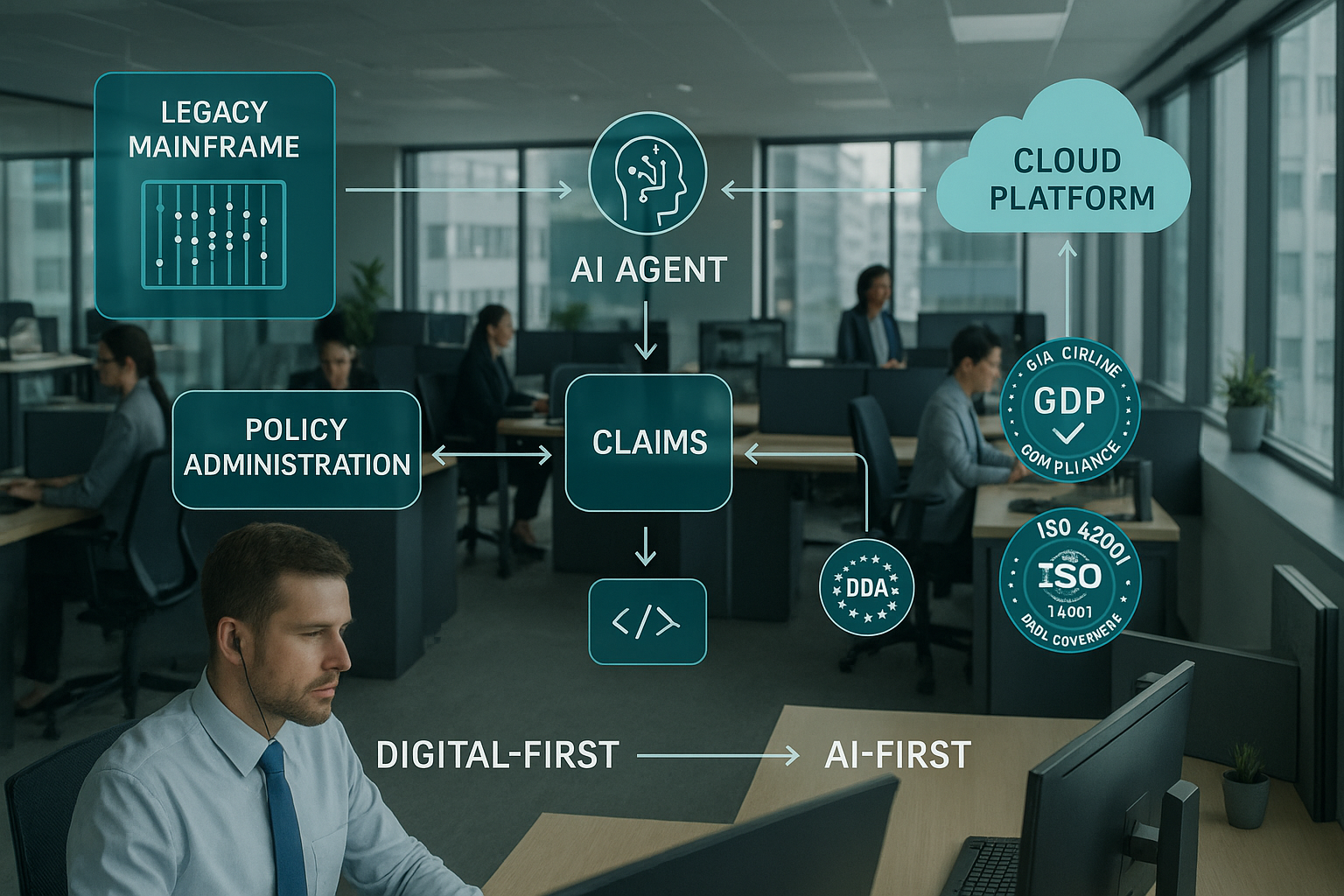

A pragmatic path for insurers shifting from digital-first to AI-first—safely and measurably.

“Digital-first” helped insurers move forms and portals online; “AI-first” rewires how decisions get made. The shift isn’t about adding another chatbot. It’s about turning claims, underwriting, servicing, and renewal moments into fast, consent‑aware decisions that are observable, auditable, and tied to business outcomes. Why now? Competitive pressure, rising customer expectations, and maturing cloud/AI stacks mean that value concentrates where timeliness and context change outcomes—status transparency that prevents calls and complaints, triage that routes complex cases to the right expert, and renewal nudges that protect lifetime value. McKinsey observes that carriers leading on AI are deploying dozens of models across the value chain and seeing measurable gains when data and decisioning are unified; see McKinsey. AI‑first requires overcoming the gravity of legacy cores. Many policy and claims systems were never designed for near–real‑time events, identity stitching, or consent‑aware activation. The answer is not a big‑bang replacement but a platform approach that layers event streaming and decision services on top of stable records. P&C case studies detail how core modernization succeeds when insurers clarify build‑buy boundaries and prioritize extensibility; see guidance on modernization trade‑offs in this overview. When the architecture supports events and policy‑driven actions, AI agents can perceive (classify, summarize), decide (apply policy with selective models), and act (notify, route, update) without brittle point‑to‑point code. Economics are improving, but discipline matters. Legacy spend often consumes most of the IT budget, starving transformation. Modernization business cases that factor in reduced cycle time, lower cost‑to‑serve, and retention lift are gaining traction—industry write‑ups show how cloud‑based cores and orchestration shrink run cost while increasing change velocity; for perspective on the cost of legacy drag, see this synthesis: BayOne. At the same time, governance cannot be an afterthought. A risk‑based approach like the NIST AI RMF and an ISO/IEC 42001‑style management system help align speed and safety. When customers see timely, transparent updates and consistent outcomes, trust rises—and so does ROI.

Modernization succeeds or fails on architecture and controls. Start with a clear boundary between systems of record and systems of engagement: core policy, billing, and claims remain the authoritative ledger; an orchestration layer mediates events and actions with versioned, well‑documented APIs. This decoupling lets you introduce AI decisioning without destabilizing the core. Where the legacy stack cannot emit events, add change‑data‑capture or a lightweight adapter to publish domain events into a streaming backbone. Cloud reference designs for low‑latency stream analytics and online features show how to move from batch to near–real time while preserving lineage and access control; see Google Cloud for patterns you can adapt. Treat decisioning as a service rather than burying models inside channels. A policy layer—rules first, models where needed—chooses actions (route, notify, escalate) against consent‑aware profiles and writes an immutable decision log. This is how you preserve auditability when cycle times shrink from days to seconds. McKinsey highlights that unlocking AI value in insurance requires unifying data flows and layering decisioning across the value chain, not scattering models inside siloed apps; see McKinsey. Reliability and safety are engineered, not assumed. Introduce new agent behaviors with blue/green or canary releases to limit blast radius and enable instant rollback; a concise primer on zero‑downtime practice is available at HashiCorp. Build observability into the path from event to action: distributed tracing, structured logs, and SLO dashboards that track latency, errors, and saturation alongside business KPIs (claim cycle time, cost‑to‑serve, NPS). Guides for non‑SRE leaders explain why observability underpins trustworthy automation; see Splunk. Compliance must be by design. Enforce least‑privilege access, PII minimization, and region‑aware data controls at the orchestration edge. Align governance with the NIST AI RMF and manage AI operations under an auditable program such as ISO/IEC 42001; a practical implementation overview is here: ISMS.online. With this pattern—clean boundaries, event streams, policy‑driven decisioning, progressive delivery, and built‑in governance—insurers can modernize confidently without “breaking the core.”

Programs stall not because the target architecture is wrong but because the operating model is missing. Start by naming high‑value, time‑sensitive decision points across the lifecycle (FNOL triage, fraud flags, claim status transparency, renewal windows). For each node, define a KPI and counterfactual, allowable data, and a risk tier that dictates testing depth and human oversight. Run a staircase rollout: 1) shadow mode with read‑only recommendations; 2) supervised actions for low‑risk nodes behind feature flags; 3) expand to moderate‑risk nodes after lift is proven; 4) continuous optimization with fatigue and drift monitoring. Measurement keeps everyone honest. Attribute lift at the journey‑node level, not by channel: “day‑3 status update reduced inbound calls by X% and raised CSAT by Y,” “renewal nudge improved 12‑month retention by Z points.” Where randomization is possible, use it; otherwise, adopt quasi‑experimental designs (matched cohorts, difference‑in‑differences) with stop‑loss thresholds and instant rollback. External benchmarks can help set expectations: case libraries show automation trimming claims cycle time and cost‑to‑serve when built on clean, connected data; for a directional view, see Ricoh. Broader operations research underscores the value of observability and progressive delivery to scale changes safely; primers at Harness capture the principles well. Change management is the multiplier. Upskill adjusters and product owners on how to interpret decision logs and override recommendations. Pair AI outcomes with customer‑facing transparency (plain‑language explanations, predictable updates) to reinforce trust. Publish monthly value realization reviews that reconcile incremental lift with costs (integration, inference, human‑in‑the‑loop) and risk posture. Industry outlooks point to multi‑year modernization journeys focused on cloud cores and platform thinking—see Deloitte’s insurance outlook at Deloitte. The destination is AI‑first: decisions made in the moment, governed by policy, observable end‑to‑end—and always measured against outcomes that matter.

A practical blueprint to run privacy‑first, AI‑driven programs at scale.

A practical blueprint for compliant, scalable AI personalization that builds trust.