Privacy‑First AI: A Practical Enterprise Framework

A practical blueprint to run privacy‑first, AI‑driven programs at scale.

AI You Can Be Sure blog is the go-to resource for specialty insurance professionals navigating AI automation and digital transformation.

A practical blueprint to run privacy‑first, AI‑driven programs at scale.

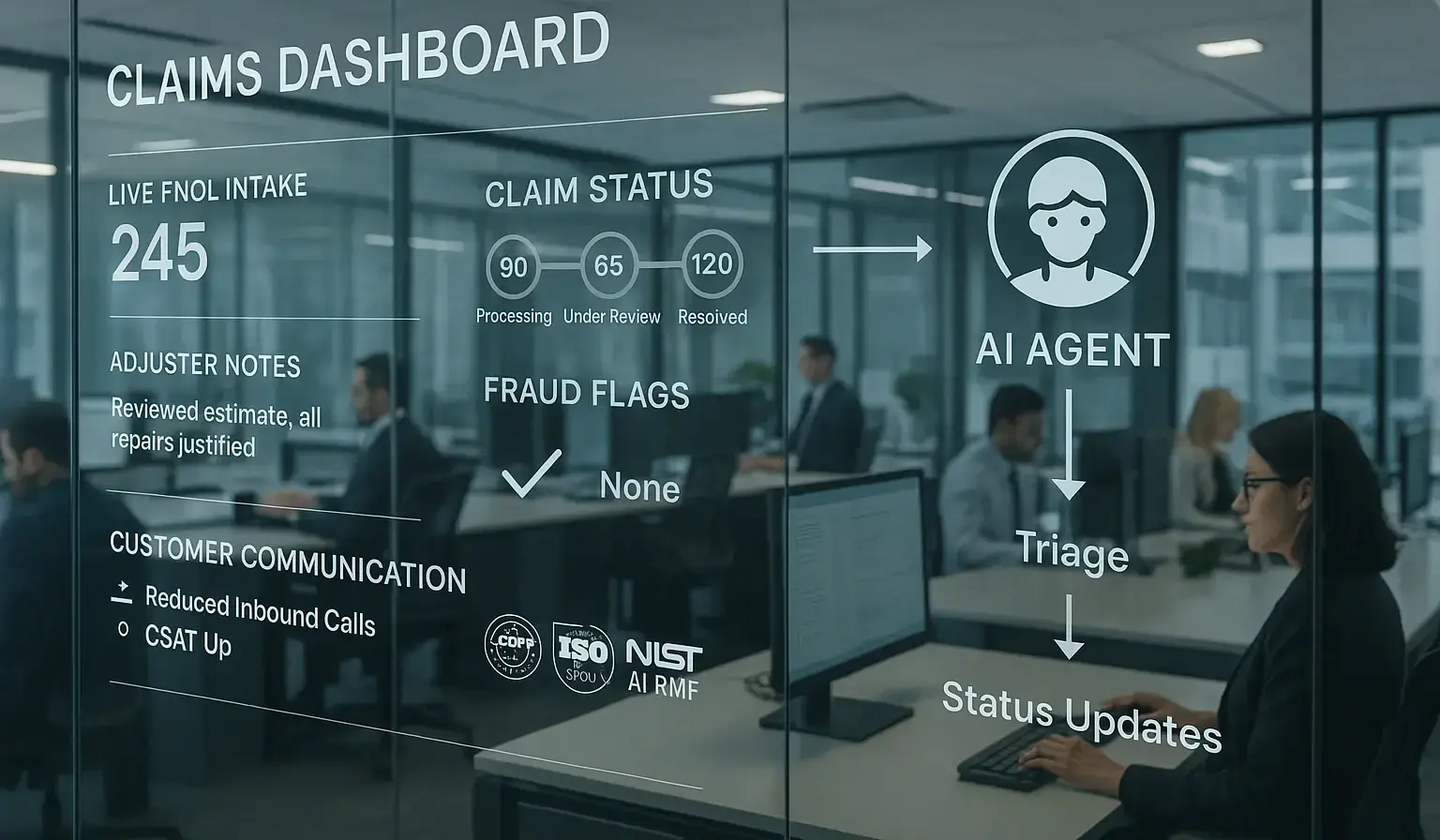

Claims transparency delivers fast ROI by cutting calls and raising CSAT.

When does AI personalization pay? A CFO‑ready guide to ROI and risk.

How brokers can use AI to personalize outreach, protect trust, and grow share.

A pragmatic blueprint for consent-first, real-time personalization that pays.

A practical, compliant guide to FNOL automation that speeds specialty claims and proves ROI.

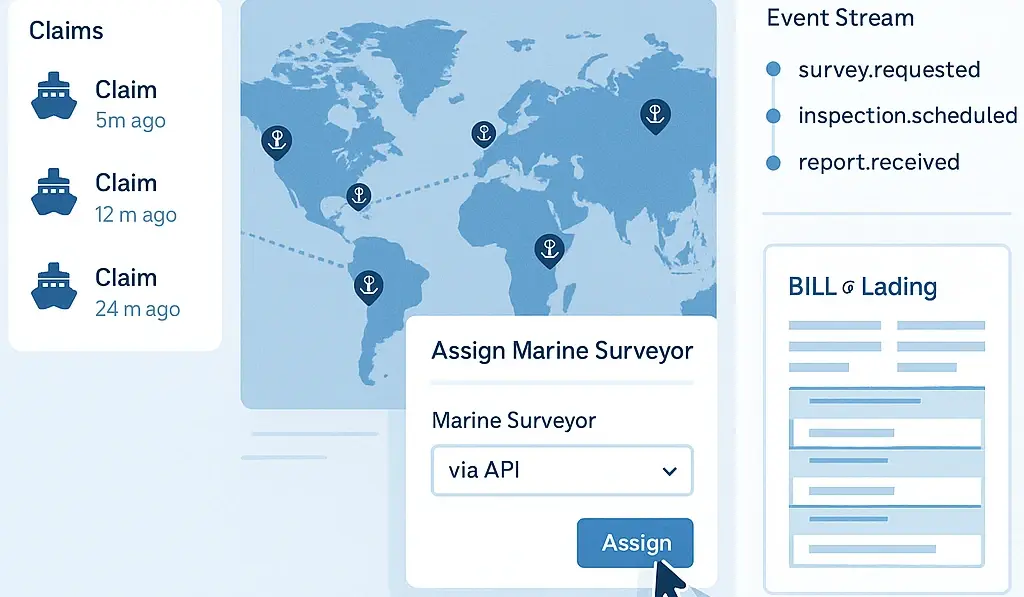

How APIs and events cut days from marine survey assignment and reporting.

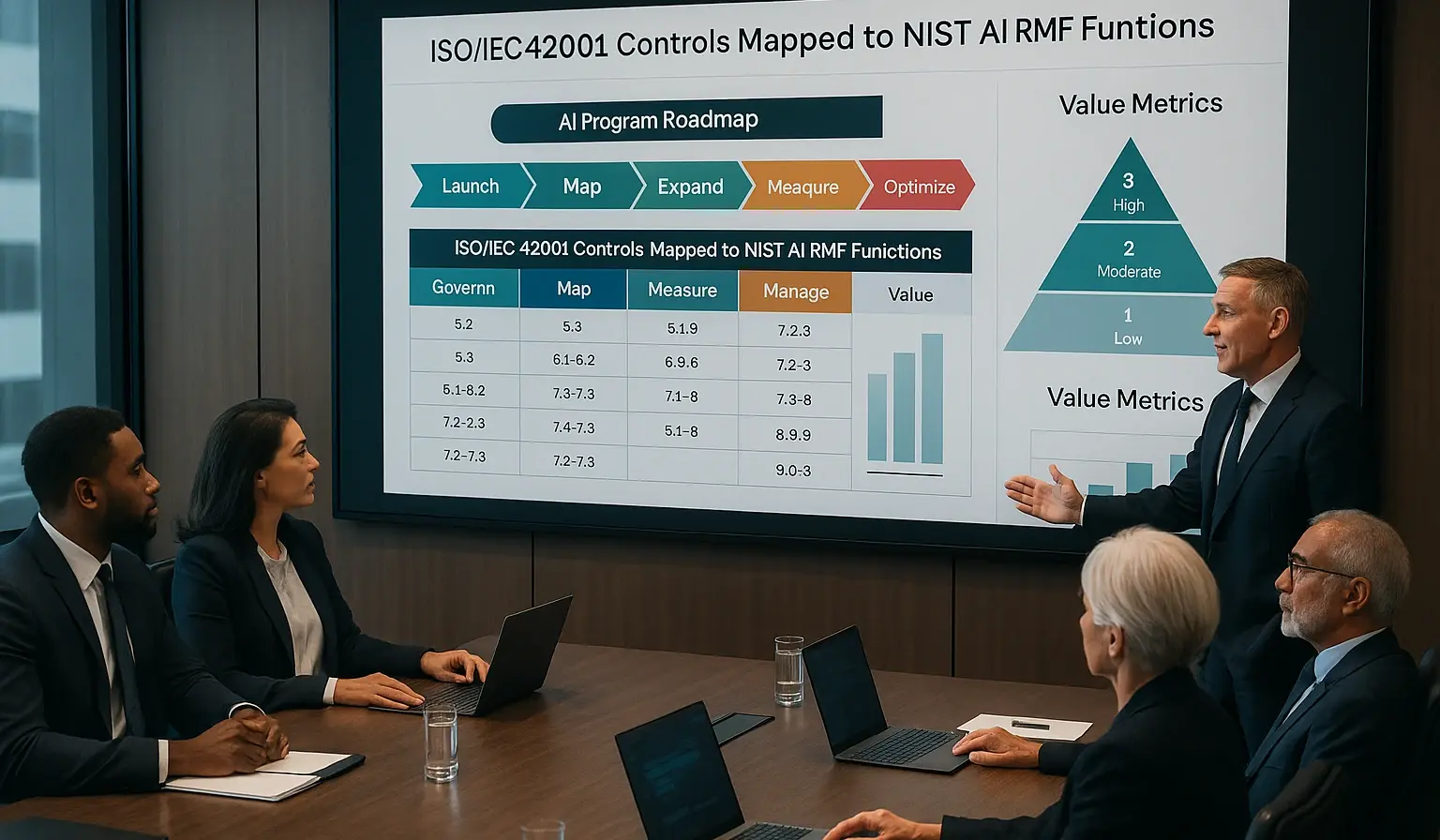

A step-by-step playbook to set strategy, build capability, and scale AI safely.

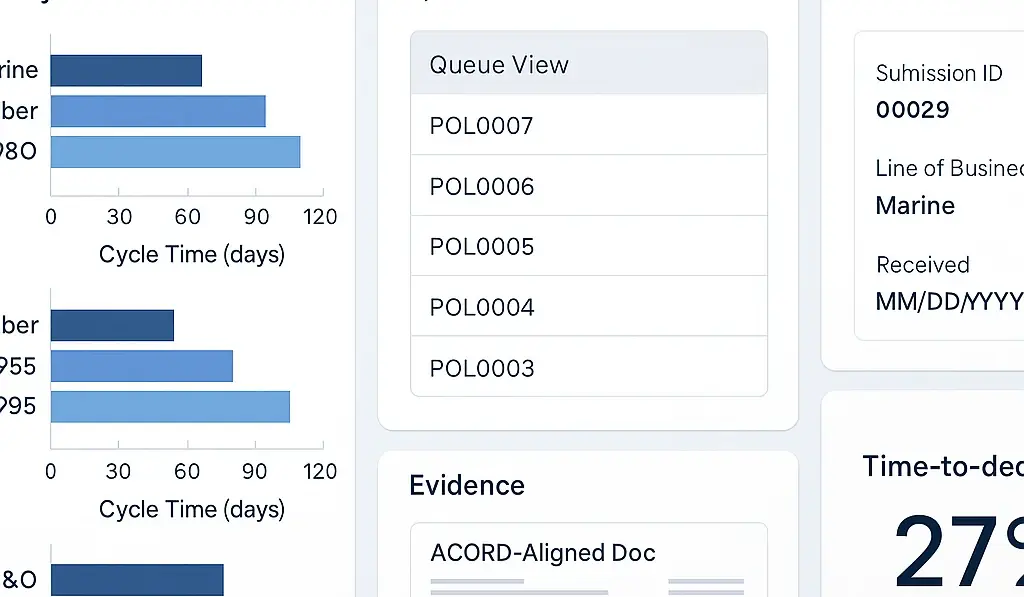

A benchmark framework to cut specialty underwriting time without risk.

A practical blueprint to turn insurance data into compliant, trusted AI decisions.