A CFO-ready framework to target, test, and scale AI personalization profitably. Personalization works—but only in the right places, at the right depth, and with the right measurement. Many programs underperform not because the technology lacks power, but because teams chase breadth over impact.

Where personalization pays—and where it doesn’t

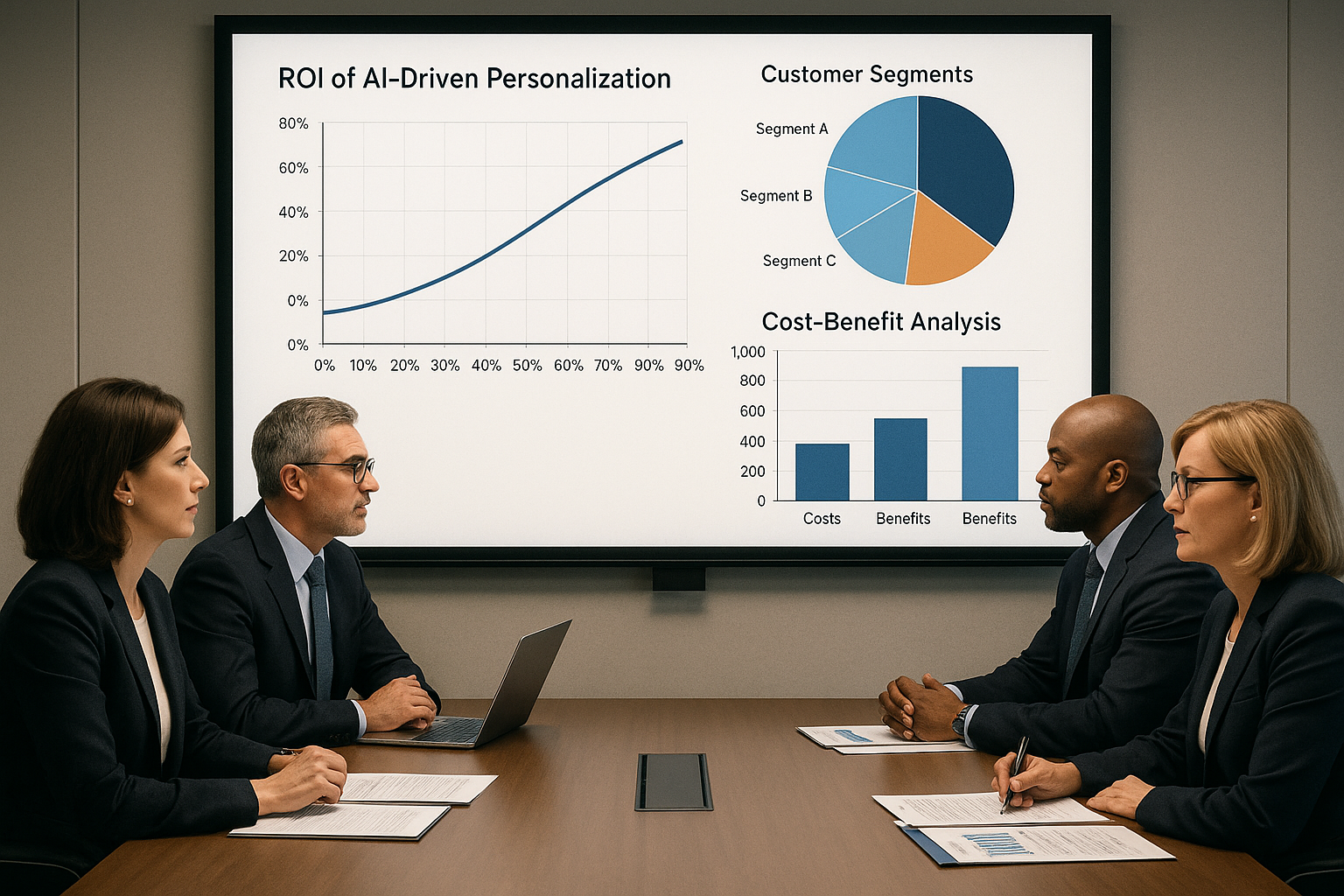

The goal is to identify the segments, moments, and channels where personalization changes decisions, not just clicks. Industry benchmarks show why: McKinsey reports that firms effectively applying AI-driven personalization can both lift revenue and reduce acquisition costs by up to 50% (McKinsey). Adobe and Forrester’s latest research highlights that leaders are consolidating data and activating it in real time across journeys—seeing superior loyalty and lifetime value (Adobe & Forrester). But returns aren’t linear. The first 20% of effort—centralizing customer data, standardizing IDs, and using simple rules-based offers—often delivers outsized value. The next 80%—micro-segmentation, dynamic creative across dozens of channels, and complex models—may deliver diminishing returns if not tightly targeted. External roundups echo this pattern: while many statistics tout uplift, the spread is wide, with context determining payoff (AMR & Elma). For MapleSage’s enterprise ICP—insurance, SaaS, and retail—the winning pattern is to prioritize high-value use cases like claim-status outreach, churn-risk saves, expansion nudges, and next-best-offer triggers in moments that directly affect revenue or service cost.

Cost curves, privacy, and operational constraints

The economics of personalization are governed by two curves: value and cost. Value rises as you better match message to moment and customer, but it plateaus once you’ve captured the most responsive opportunities. Costs rise with data integration, model training, experimentation, orchestration, and creative operations. Meanwhile, privacy and compliance create hard constraints—consent management, PII minimization, auditability, and regional data residency—which, if addressed late, can erase ROI. Adobe’s recent guidance underscores the gap between consumer expectations and the operational reality many brands face (Adobe). To keep the curves favorable, anchor each personalization use case to a measurable decision and a credible counterfactual. What would have happened without it? Focus early investments on audience stitching (CDP), event collection, and a simple decisioning layer that can test hypotheses quickly. Define guardrails: allowable data, frequency caps, consent logic, and bias checks. Don’t pursue 1:1 where 1:few wins; in insurance, for instance, a handful of lifecycle interventions (renewal reminders with tailored benefits, claims transparency updates) may beat hundreds of micro-variations. Curate the model portfolio—often one well-governed propensity or Uplift model per journey node outperforms a sprawl of overlapping algorithms. This is how MapleSage’s SageInsure and SageRetail programs reach profitable personalization without operational bloat.

A CFO-ready model for pilots, metrics, and scale

A CFO-ready roadmap starts with unit economics per journey node. Define for each use case: target segment, expected lift, cost to run (data, modeling, activation, creative), risk controls, and a payback period goal. Require randomized control or strong quasi-experimental designs wherever possible to isolate incremental impact. Use rolling canary tests: ship to 5–10% of traffic, set hard stop-loss thresholds, and scale only when 80% confidence bounds clear your hurdle rate. Reference points from industry research can guide targets—McKinsey’s surveys and Adobe/Forrester’s benchmarks provide directional ranges for uplift and cost envelopes (McKinsey; Adobe & Forrester). Operationalize measurement: weekly experiment readouts, monthly portfolio reviews, and a quarterly reallocation of spend to the highest-ROI journeys. Bake privacy into the process—consent capture, subject rights handling, and data minimization—so legal and brand risk never blindsides the P&L. Finally, build the flywheel: use wins to fund the next set of experiments, elevate your analytics maturity, and extend from core to adjacent journeys (from onboarding to retention to expansion). MapleSage clients who follow this discipline move beyond “personalization theater” to documented, defensible returns that finance leaders can trust.