From RPA to Intelligent Agents: What Changes Now

A practical guide to evolving from RPA to intelligent, agentic automation.

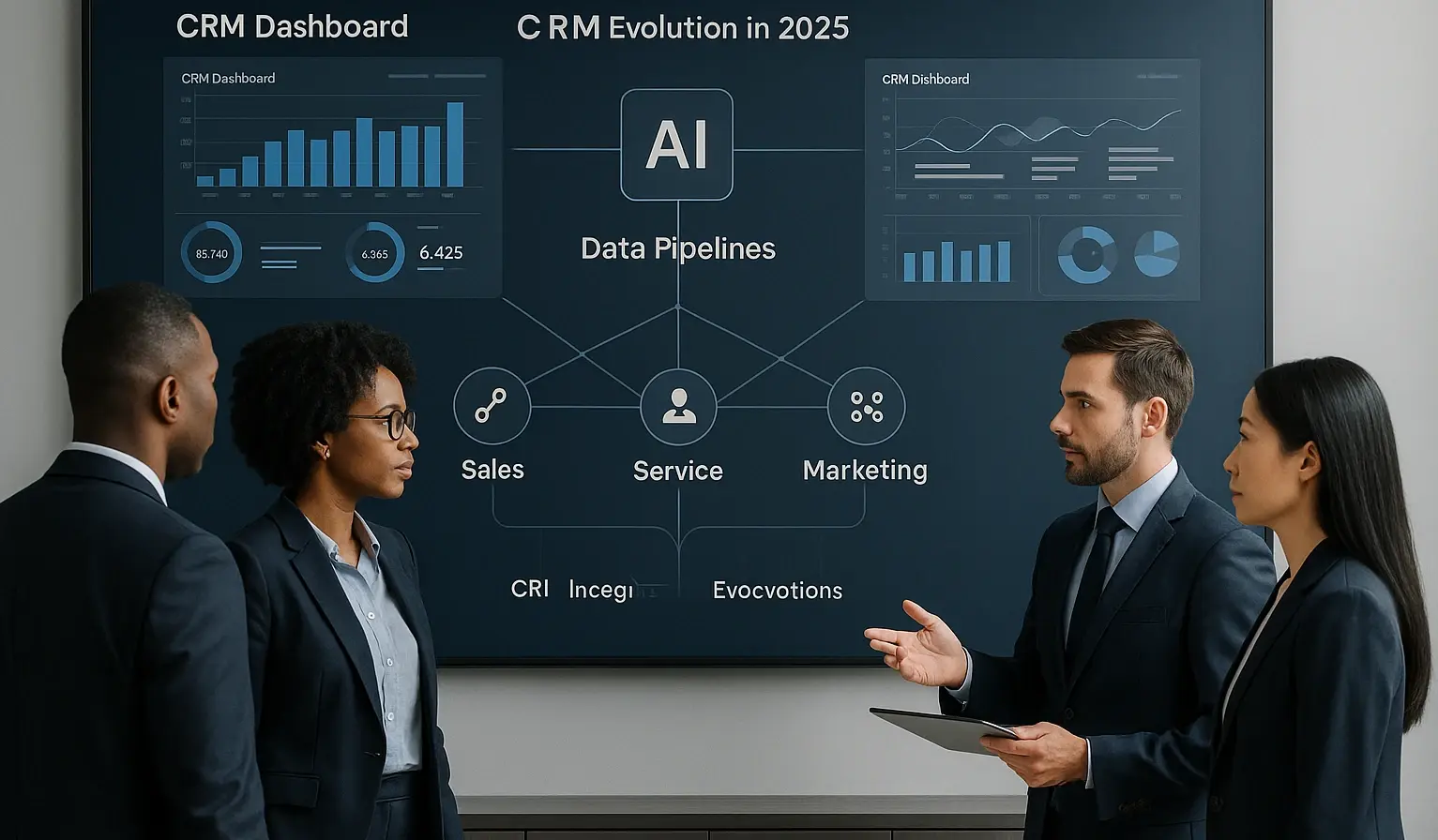

A pragmatic look at AI‑native CRM in 2025, what still matters, and how to buy and operate it. The last decade turned CRM into the system of customer record; 2025 is turning it into the system of customer intelligence.

Three forces drive the shift: AI embedded across sales, service, and marketing; unified, near–real-time data; and automation that acts on insights, not just reports. “CRM plus AI” is no longer a slide—platforms now route leads, summarize conversations, draft follow-ups, score opportunities, and orchestrate next-best actions with growing reliability.

In parallel, data pipelines are modernizing: identity stitching through CDPs, event collection at high granularity, and governance that makes more of the data actually usable in production. The result is a CRM that feels more like an operating system for growth, with workflows and agentic services running on top. Salesforce notes that organizations are consolidating stacks around AI-enabled CRM to connect data for automation and personalization (Salesforce).

Wider tech trends reinforce this trajectory: McKinsey’s 2025 outlook highlights agentic AI, advanced connectivity, and cloud-edge patterns accelerating real-time decisioning (McKinsey; PDF overview of 2025 trends here). Practically, this means CRMs are becoming AI-native: models surface signals directly in the user workflow, copilots assist with planning and execution, and automation triggers from unified events.

The impact shows up in cycle-time compression, more consistent customer experiences, and better attribution of what actually moves revenue and retention. For MapleSage’s ICP—insurance, SaaS, and retail—the move to AI-native CRM enables proactive service (claims updates, renewal nudges), smarter routing, and real-time personalization grounded in consent and compliance. The key is not “more AI” but “better-integrated, trustworthy AI” that turns CRM from a passive database into a decisive system of action.![]()

For all the innovation, fundamentals still determine outcomes. First, governance: data access, retention, lineage, and consent management are the bedrock of trustworthy AI. Without this, models drift, personalization backfires, and compliance risks spike. Second, adoption: productivity lifts only materialize when workflows are designed around how teams actually sell and serve. Copilots that flood reps with suggestions but don’t fit their cadence get ignored. Third, data quality: unified IDs, deduplication, and consistent taxonomy are nonnegotiable.

Even the best models underperform on noisy, siloed data. Independent of vendor hype, leaders that scale AI report value at the use-case level, not from generic deployments. McKinsey’s 2025 State of AI survey shows a growing share of organizations realizing concrete savings and gains—but most have not yet scaled across the enterprise, underscoring the need for disciplined governance and change management (McKinsey).

Meanwhile, Gartner’s AI Hype Cycle reminds buyers to separate transient buzz from durable capabilities and to build measurement into every release (Gartner). The lesson for 2025: AI-native CRM succeeds when rooted in clear outcomes—faster response, higher win rates, lower churn—and when teams close the loop between data, decisions, and delivery. MapleSage’s approach emphasizes maturity stages: start with read-only insights, move to supervised actions, then automate narrow, high-confidence tasks. This staircase preserves trust while compounding returns.

Selecting and operating a 2025-ready CRM requires a balanced checklist that blends platform capabilities with operating model design. Platform: prioritize native AI copilots with transparent controls, robust CDP/ETL integrations for identity and events, and security features covering field-level permissions, PII minimization, audit logs, and regional data controls.

Ensure open APIs and event streams to plug in specialized agents without brittle point-to-point wiring. Integrations: verify first-class connectors to your finance, support, data warehouse, and communications stack; confirm support for near–real-time ingestion and activation so decisions can happen in the moment. Operating model: define RACI across sales, CS, data, and IT; set service level objectives (latency, uptime, data freshness); and instrument business KPIs (conversion, AHT, NPS, net retention) to attribute impact credibly.

Cross-reference market perspectives on CRM and AI integration trends from Salesforce and industry tech roundups (Salesforce; a concise CRM trend summary appears at SuperAGI). Finally, build for safety and scale: feature flags for new AI behaviors, canary releases, and human-in-the-loop checkpoints for higher-risk actions. With these guardrails, enterprises can evolve toward an AI-first CRM without breaking the experiences customers rely on.