The Economics of Personalization: When AI Pays Off

When does AI personalization pay? A CFO‑ready guide to ROI and risk.

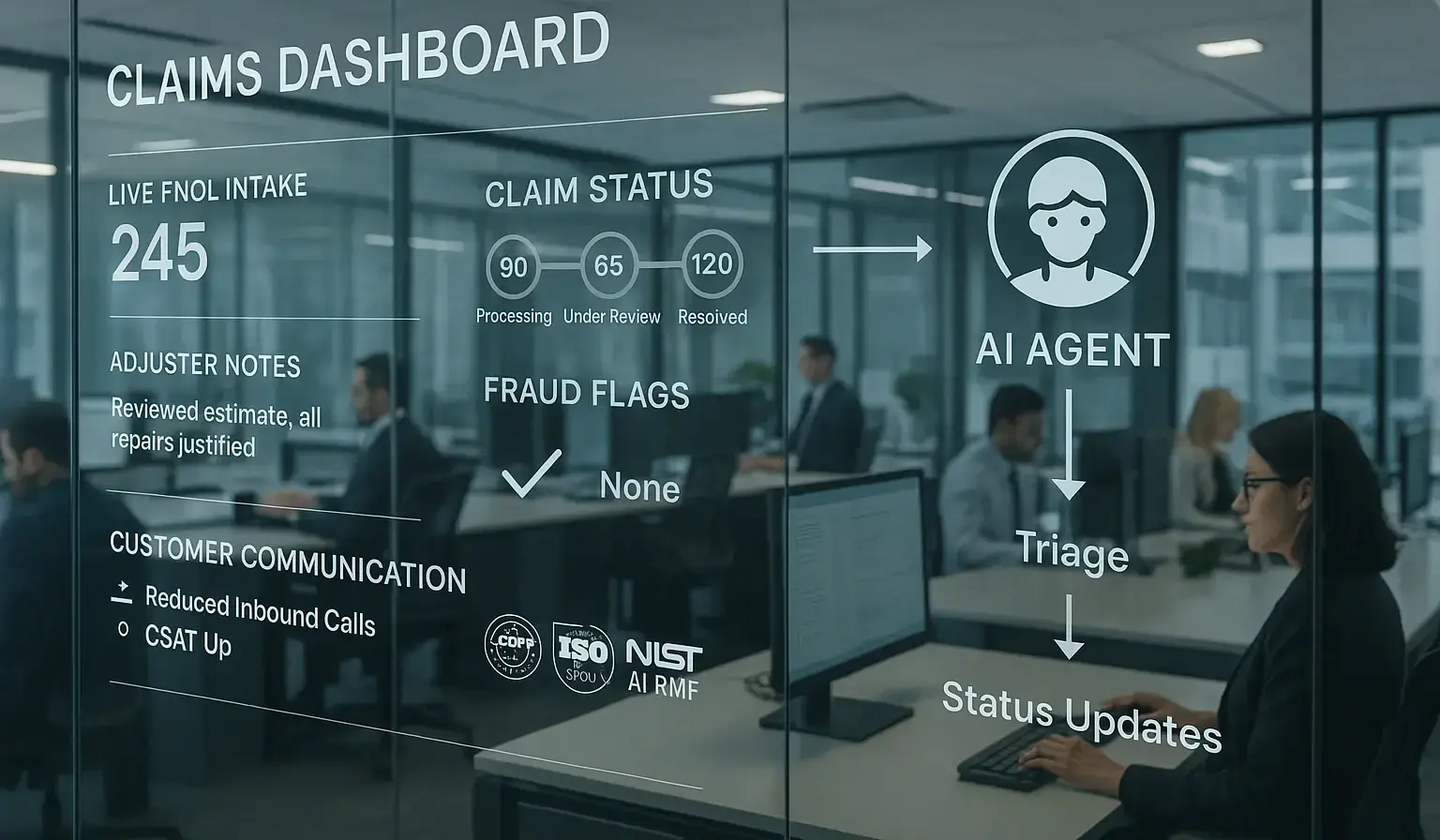

Claims transparency delivers fast ROI by cutting calls and raising CSAT.

In insurance, the fastest path from AI pilot to measurable value is surprisingly simple: make claim status transparent, timely, and proactive. Policyholders don’t just want faster settlements; they want predictable updates and clarity. Carriers that provide day‑3 status check‑ins, escalate when adjuster notes indicate complexity, and alert customers when documents are missing cut inbound calls, improve CSAT, and reduce complaint risk. Industry analyses show that leaders deploying AI across the value chain compress cycle times when data and decision flows are unified; see McKinsey.

The trap is trying to “boil the ocean”—building models everywhere before fixing the basics. Start where timeliness changes outcomes and actions are clear: status transparency. The blueprint is pragmatic. Stream events from claims systems (FNOL filed, adjuster note added, document received, payment issued) into a governed pipeline with lineage and freshness SLAs. Maintain a consent‑aware profile that links policyholder identity across claims, policy, billing, and communications.

Layer a decision service that evaluates consent and selects the next best action: send a status update, create an internal task, or route to a senior adjuster. Keep actions minimal and auditable—every message carries a reason code and is written to an immutable decision log. You don’t need ML everywhere. Rules cover most value: send status at day‑3 and day‑7, escalate on “severity” keywords, notify when medical records arrive, cap frequency per channel. Add models selectively for fraud propensity, severity triage, or uplift when outreach is expensive.

Reliability and safety come from progressive delivery (feature flags, blue/green, canaries) and observability—trace from event to action, monitor golden signals (latency, error, saturation, throughput), and pair with business KPIs (call volume, CSAT/NPS, cycle time). Leaders’ guides on zero‑downtime patterns (HashiCorp) and observability (Splunk) are practical starting points.

Do it privacy‑first. Service communications often rely on contract or legitimate interest, but you should still practice minimization and provide preference controls. Align your program with the NIST AI RMF and operate under an auditable AI management system like ISO/IEC 42001 (ISMS.online). That way, as you expand from status transparency to triage and settlement support, compliance and trust scale with you.

Automation that customers feel starts with good data and clear policies. First, unify identity and events across policy, billing, claims, broker/agent systems, and CRM. Capture FNOL, adjuster note added, document received, and settlement issued as domain events with schemas, lineage, and freshness SLAs. Build a consent-aware profile so any outreach checks lawful basis (e.g., contract, legitimate interest, or explicit consent under GDPR Article 6) and minimization.

The GDPR legal bases are compatible with necessary service communications, but you still need transparent rationale and preference controls. Decisioning comes next: rules first, selective models where needed. Simple policies can trigger day‑3 status updates, escalate overdue tasks, or route complex claims to experienced adjusters. Add models for fraud propensity, severity triage, and outreach uplift when the surface is complex.

Crucially, each decision should

1) request a minimal context bundle,

2) evaluate consent and eligibility,

3) choose an action, and

4) write an immutable decision log with inputs, rationale, and outcome.

That log is your evidence for audits and continuous improvement. Reliability is engineered. Introduce new behaviors with feature flags and progressive delivery—blue/green and canaries—to limit blast radius; accessible primers are available from HashiCorp and Harness.

Instrument observability: distributed tracing from event to action, metrics for latency, error rate, saturation, and throughput, plus business KPIs (call volume, cycle time, CSAT/NPS). A leader‑friendly primer on observability benefits is here: Splunk.

Ship with an operating model that makes results repeatable. Start in shadow mode (read‑only recommendations) for common claims scenarios and measure counterfactuals. Move to supervised actions for low‑risk nodes (e.g., informational status updates) with canary cohorts and stop‑loss thresholds.

Expand to moderate‑risk nodes after lift is proven. Maintain a cross‑functional AI council (claims, customer service, data, security, legal) to approve decision nodes and risk tiers. Measurement must be CFO‑ready. Attribute lift at the journey‑node level: “day‑3 status update reduced inbound calls X% and raised CSAT Y,” “triage accuracy improved Z points; cycle time decreased W%.” Prefer randomized control where possible; otherwise use quasi‑experiments (matched cohorts, difference‑in‑differences).

Publish monthly value realization reviews that reconcile incremental lift with cost (integration, inference, human‑in‑the‑loop). External references summarize efficiency and satisfaction gains from AI‑assisted claims operations—see McKinsey and practical benefits roundups such as Ricoh.

Change management is the multiplier. Train adjusters to interpret decision logs, use context packs, and escalate appropriately. Provide customer‑facing transparency—why each message was sent and how to update preferences. With consent‑aware data, rules‑first decisioning, progressive delivery, and disciplined measurement, claims transparency becomes the fastest way to demonstrate AI ROI—customers feel the difference, and the contact center does too.

A seasoned technology sales leader with over 18 years of experience in achieving results in a highly competitive environment in multiple service lines of business, across the Americas, EMEA & APAC. Has a strong understanding of international markets having lived and worked in Asia, the Middle East and the US, traveled extensively globally.