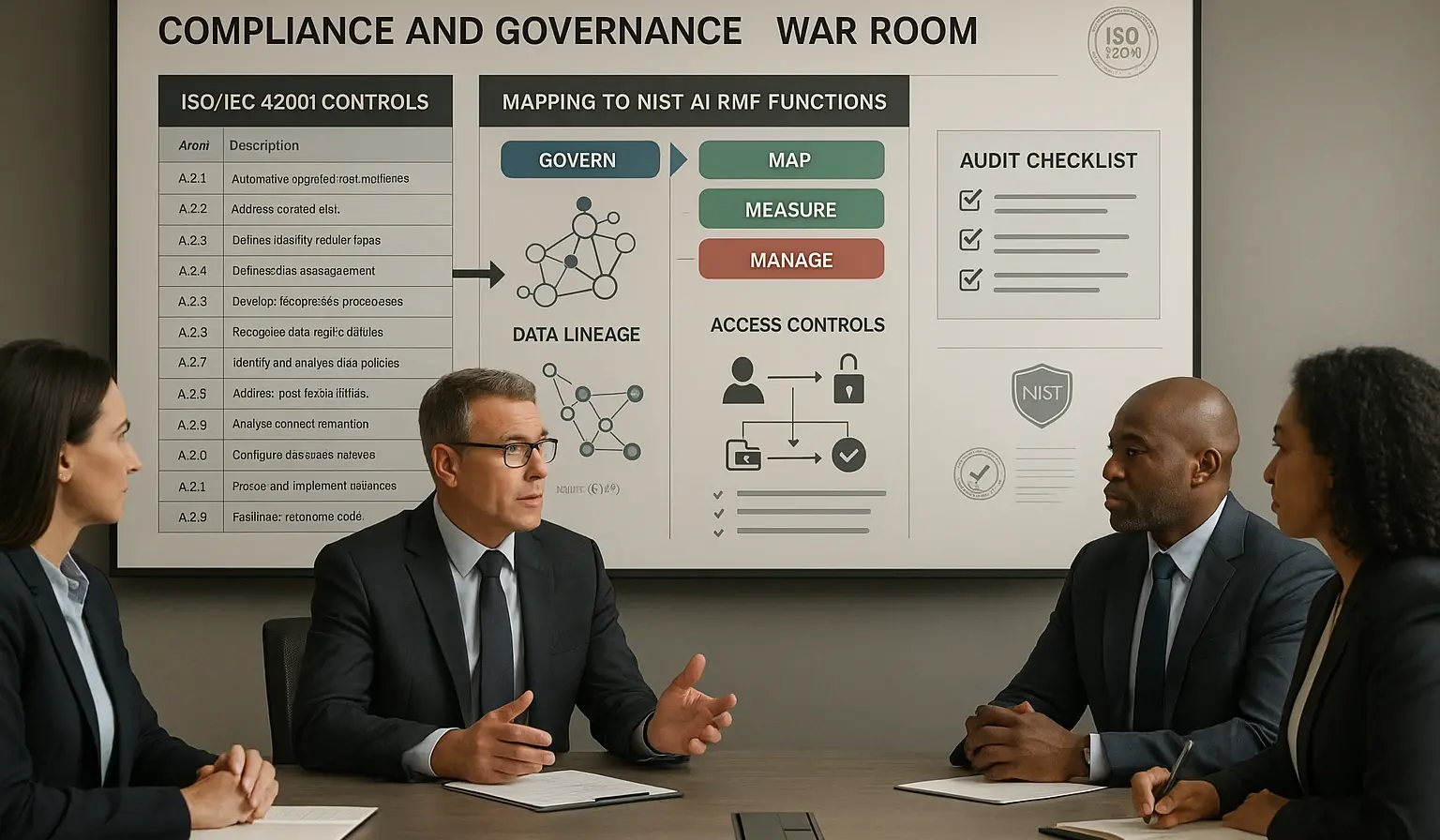

ISO 42001 + NIST: Operationalizing AI Governance

A step-by-step playbook to run AI safely with ISO 42001 and NIST AI RMF.

AI You Can Be Sure blog is the go-to resource for specialty insurance professionals navigating AI automation and digital transformation.

Posts by

A step-by-step playbook to run AI safely with ISO 42001 and NIST AI RMF.

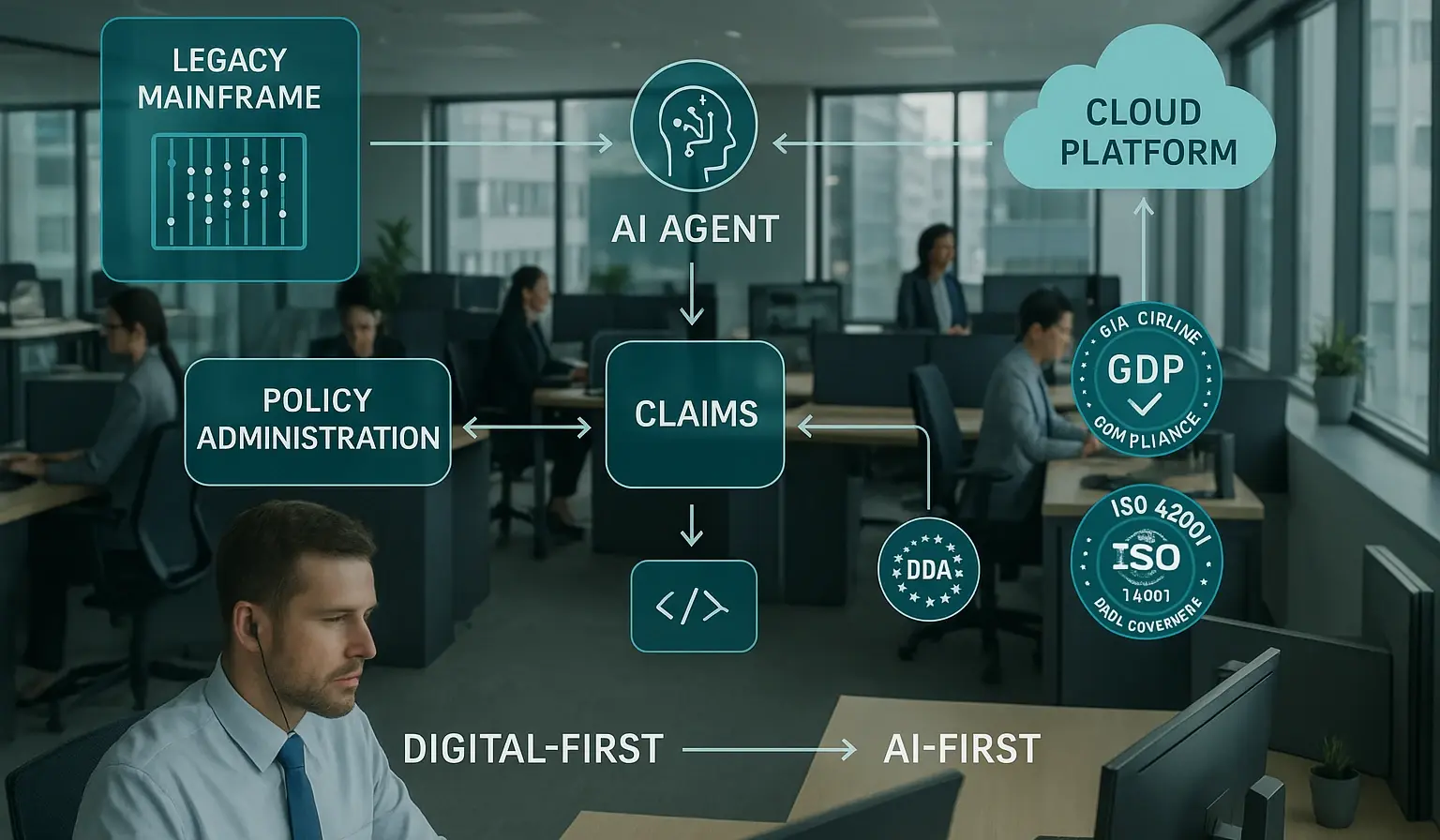

A pragmatic path for insurers shifting from digital-first to AI-first—safely and measurably.

Why more data can slow decisions—and how to build a quality-first analytics engine.

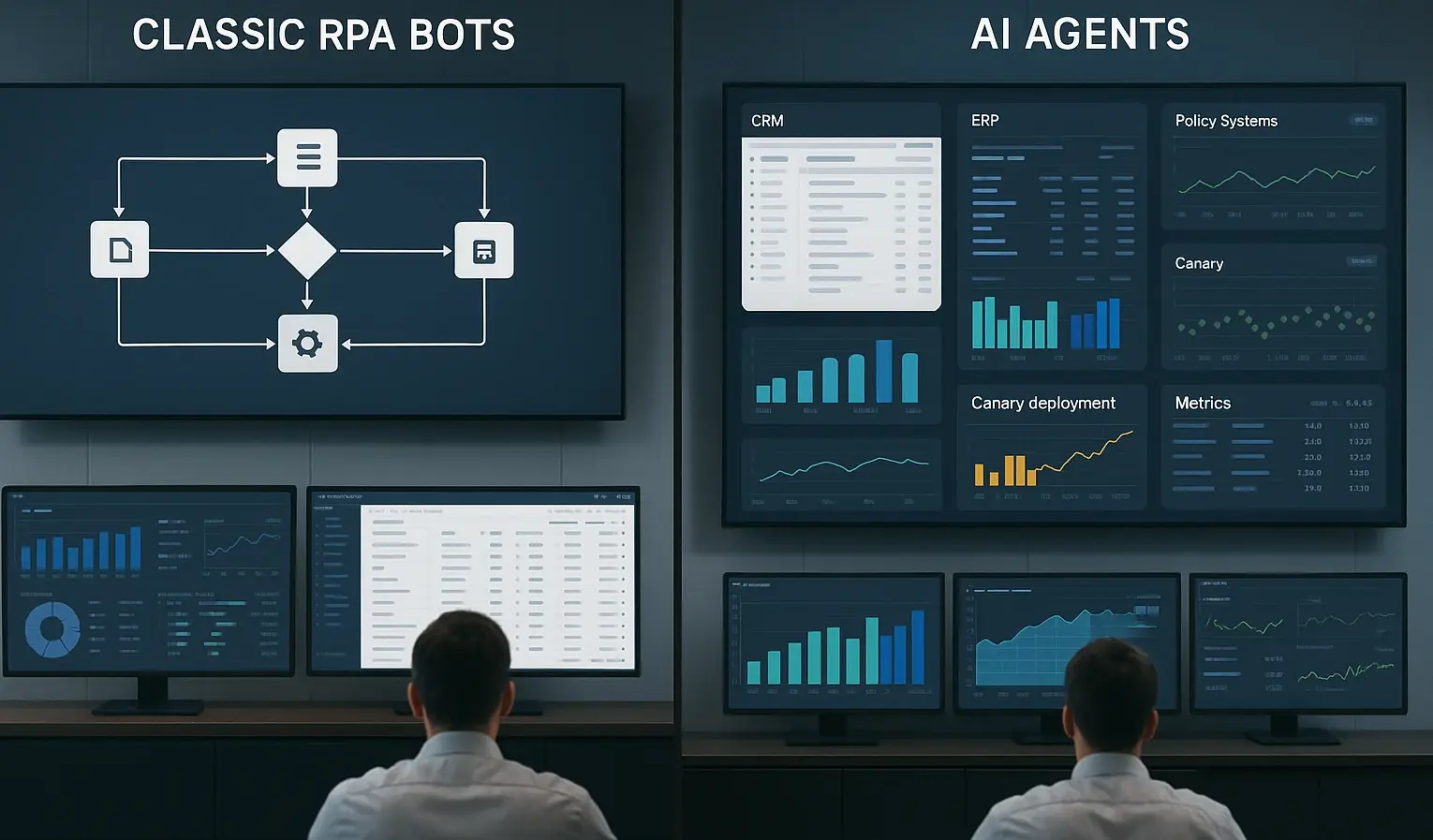

A pragmatic blueprint for combining RPA with agentic AI—safely.

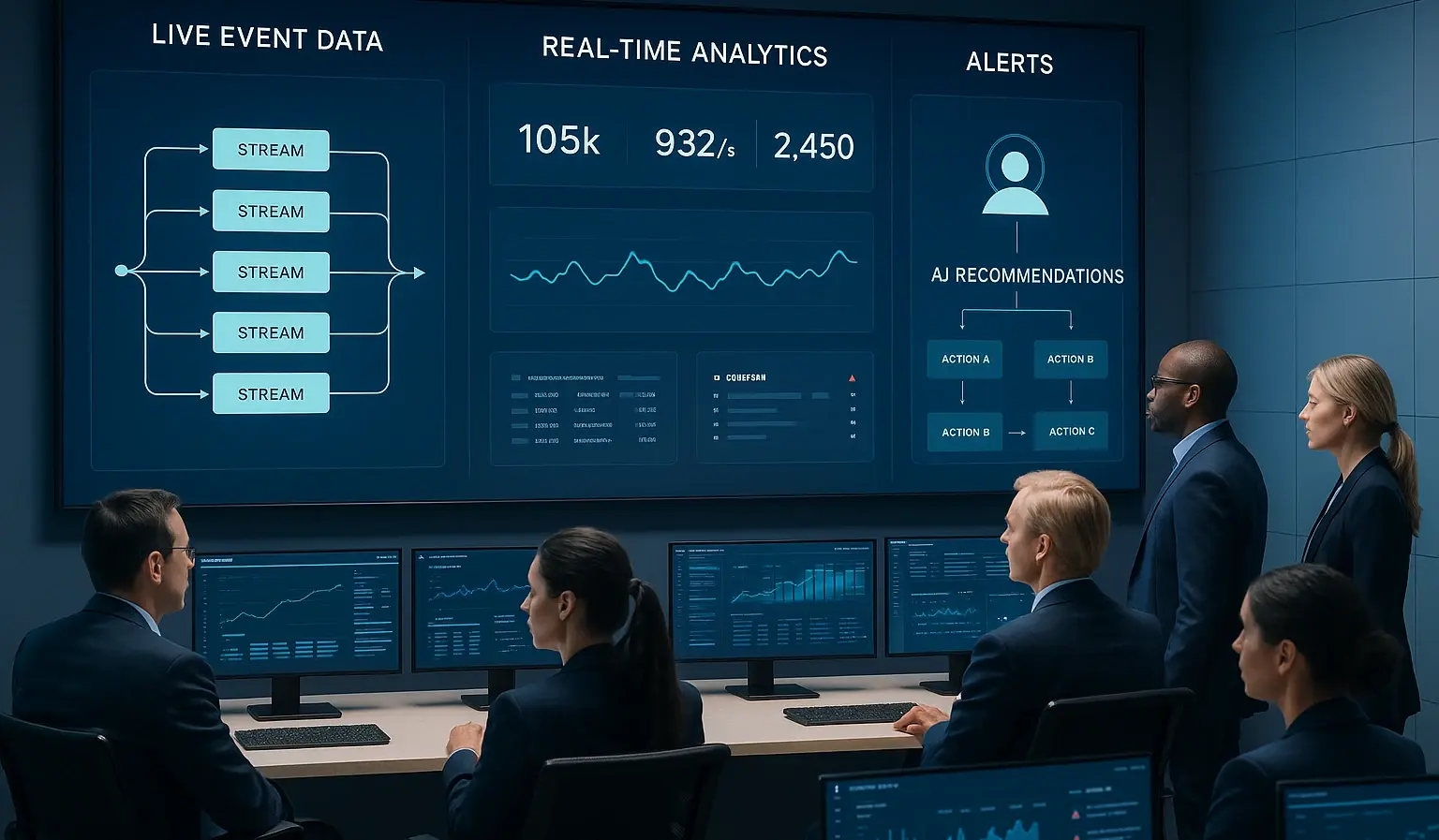

How real-time analytics and AI shift decisions from reports to results.

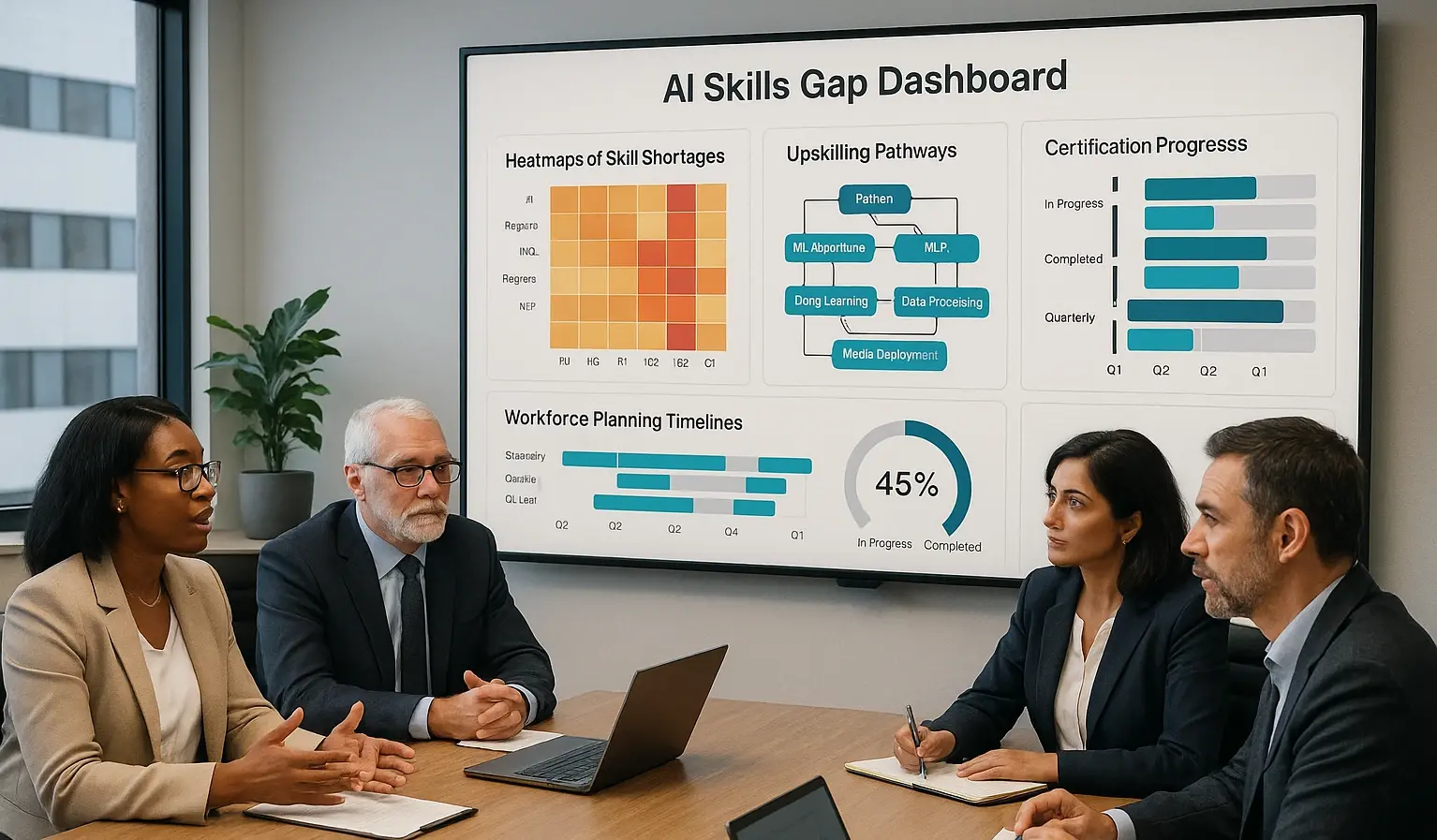

A practical playbook to build and keep the AI talent you need in 2025.

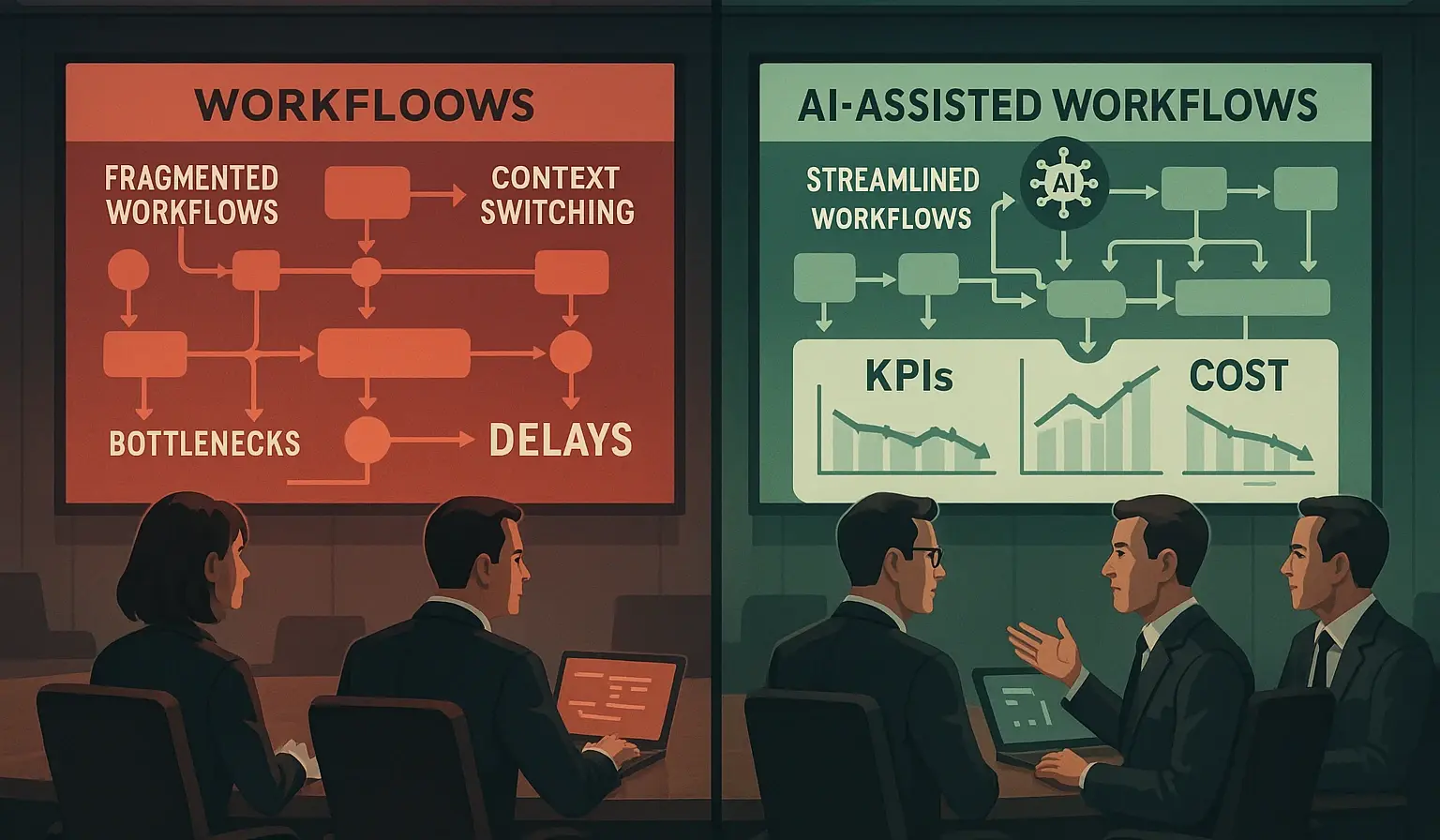

Quantify hidden workflow waste and apply AI to reclaim time and margin.

A practical guide to loyalty built on personalized journeys, not points.

A practical blueprint for compliant, scalable AI personalization that builds trust.

An applied guide to CLV modeling for insurers—and how to turn it into saves. Customer Lifetime Value (CLV) is the north star for profitable growth in insurance because it integrates risk, premium, service cost, and retention into a single forward‑looking metric.